Charitable Giving: DuPage County’s predicted wealth transfer has huge implications

By Dave McGowan

The 2020 Illinois Transfer of Wealth Study reveals an astonishing trend: DuPage County residents are transferring more wealth than ever before, and this unique moment won’t last forever. We’re now in the final five years before we reach the peak at the end of 2028.

The 2020 Illinois Transfer of Wealth Study reveals an astonishing trend: DuPage County residents are transferring more wealth than ever before, and this unique moment won’t last forever. We’re now in the final five years before we reach the peak at the end of 2028.

Back in 2005, only 6% of DuPage County’s wealth was transferred. By 2028, that figure is expected to more than double, reaching an impressive 14%, before settling at around 10%. This remarkable growth translates to nearly $53 billion moving through DuPage County estates within a decade.

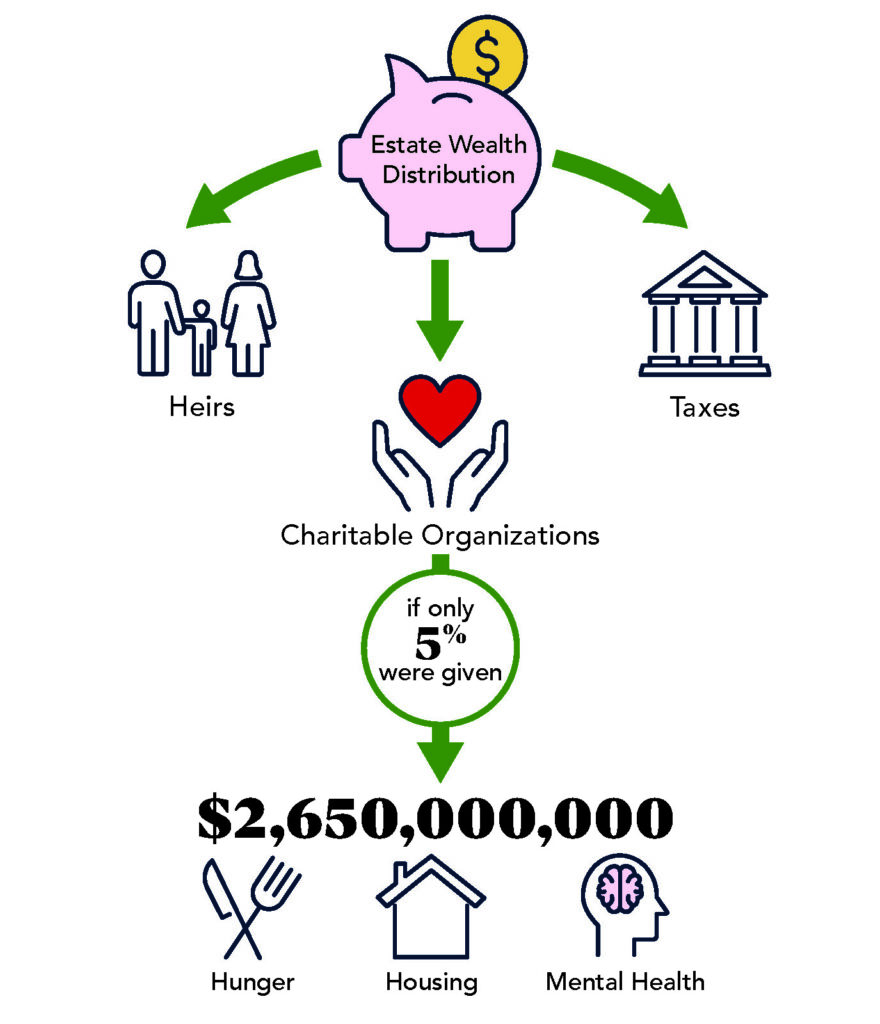

When the last of a household’s spouses passes away, their estate is distributed among heirs, charitable organizations, and taxes. As a fundraiser with 43 years of experience, I’m advocating for more of this wealth to be directed toward charitable causes. If just 5% were allocated to charities, it would generate $2.65 billion for community endowments or to directly support nonprofits addressing hunger, housing instability, and mental health challenges, among other issue areas that may be important to you.

For those considering donations, contact your estate planning attorney to explore giving strategies from your estate. If you don’t already have an attorney, contact:

dpestateplan.org/Member-Directory or www.dcba.org/page/FindLawyer.

Nonprofit organizations should engage their loyal donors in conversations about the significant impact their bequests could make. You don’t need to be an expert in gift planning and tax laws – more than 85% of estate gifts are simple bequests. The donors’ professional advisors will guide you through gift acceptance strategies for more complex planned gifts.

For more information, contact me or your local community foundation at dupagefoundation.org. You can also access the full “Illinois Transfer of Wealth Study” there.

About the Author: Dave McGowan has been prominent in the Chicago-area nonprofit sector since 1981. He is a certified fundraising executive who retired from DuPage Foundation after 25 years before starting a consulting practice serving donors, their advisors, and the nonprofits they support. You can reach Dave at 630-728-2367 or dave@davemcgowanconsulting.com.