New Tax Incentive to Support Your Local Community Forever

Illinois donors now have a compelling reason to con-tribute to local community foundation endowments. The Illinois Gives Tax Credit (www.tax.illinois.gov/programs/illinoisgives) launched on January 1, offering significant state tax relief for contributions to permanently en- dowed funds at qualified Illinois community foundations.

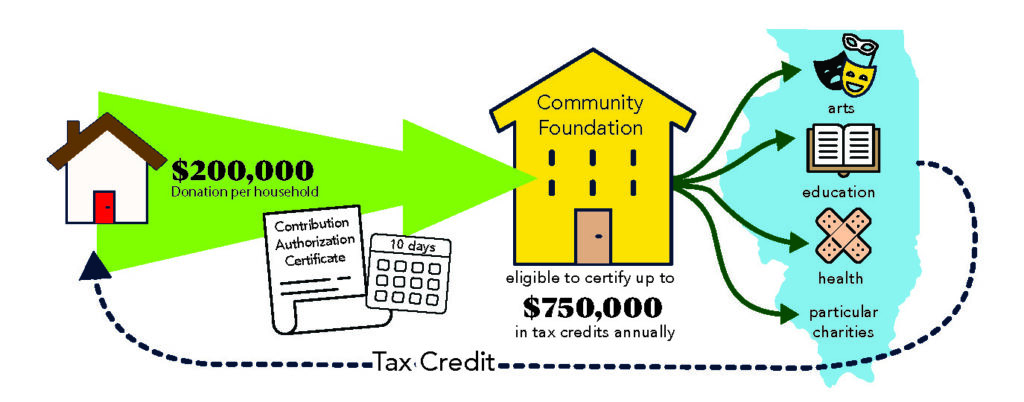

This new program provides a tax credit of up to $100,000 per taxpayer in a household, allowing a maximum household credit of $200,000. The credit applies to contributions made to new or existing endowed funds that support unrestricted grant-making; specific fields like arts, education, or health; or particular charities. Donor-advised funds are excluded. Taxpayers can take advan-tage of this credit whether they itemize deductions or opt for the standard deduction, making it accessible to a broad range of residents.

To qualify, donors must apply online through MyTax.Illinois.gov and obtain a Contribution Authorization Certificate (CAC) from the State. Once they have the certificate, donors must complete their gift to a Qualified Community Foundation within 10 business days. The State has allocated $5 million in credits annually, awarded on a first-come, first-served basis. Twenty-five percent of these credits are reserved for gifts up to $25,000, while the remaining 75% are earmarked for larger contributions up to $400,000.

Each community foundation is eligible to certify up to $750,000 in tax credits annually, which translates to $3 million in gifts from donors. The program is expected to stimulate $20 million in annual charitable giving across Illinois, generating $100 million in donations and $25 million in tax credits between now and December 31, 2029, when the program sunsets unless extended.

Illinois is following the lead of other states like Iowa, which introduced a similar program in 2003. Iowa’s Endow Iowa Tax Credit has spurred nearly $360 million in donations from taxpayers since its inception, showcasing the potential impact of such initiatives.

The Alliance of Illinois Community Foundations (allianceilcf.org) was instrumental in bringing such a tax credit to Illinois. Local community foundations such as the DuPage Foundation (dupagefoundation.org), Community Foundation of the Fox River Valley (cffrv.org), and Oak Park-River Forest Community Foundation (oprfcf.org) have been certified by the Illinois Department of Revenue to process these tax credits. All three are compliant with National Standards for U.S. Community Foundations and are prepared to assist donors through the process. With the program expected to be highly popular, these tax credits are anticipated to be claimed quickly.

If the process seems overwhelming, don’t worry—your local community foundation can help. Their staff can guide you step-by-step to ensure you maximize this opportunity and avoid leaving “money on the table.” n

About the Author:

About the Author:

Dave McGowan has been a leader in Chicago-area non-profits since 1981. As a certified fund-raising executive and former President & CEO of DuPage Foundation, he now consults with donors, advisors, and nonprofits. For more information email dave@davemcgowanconsulting.com